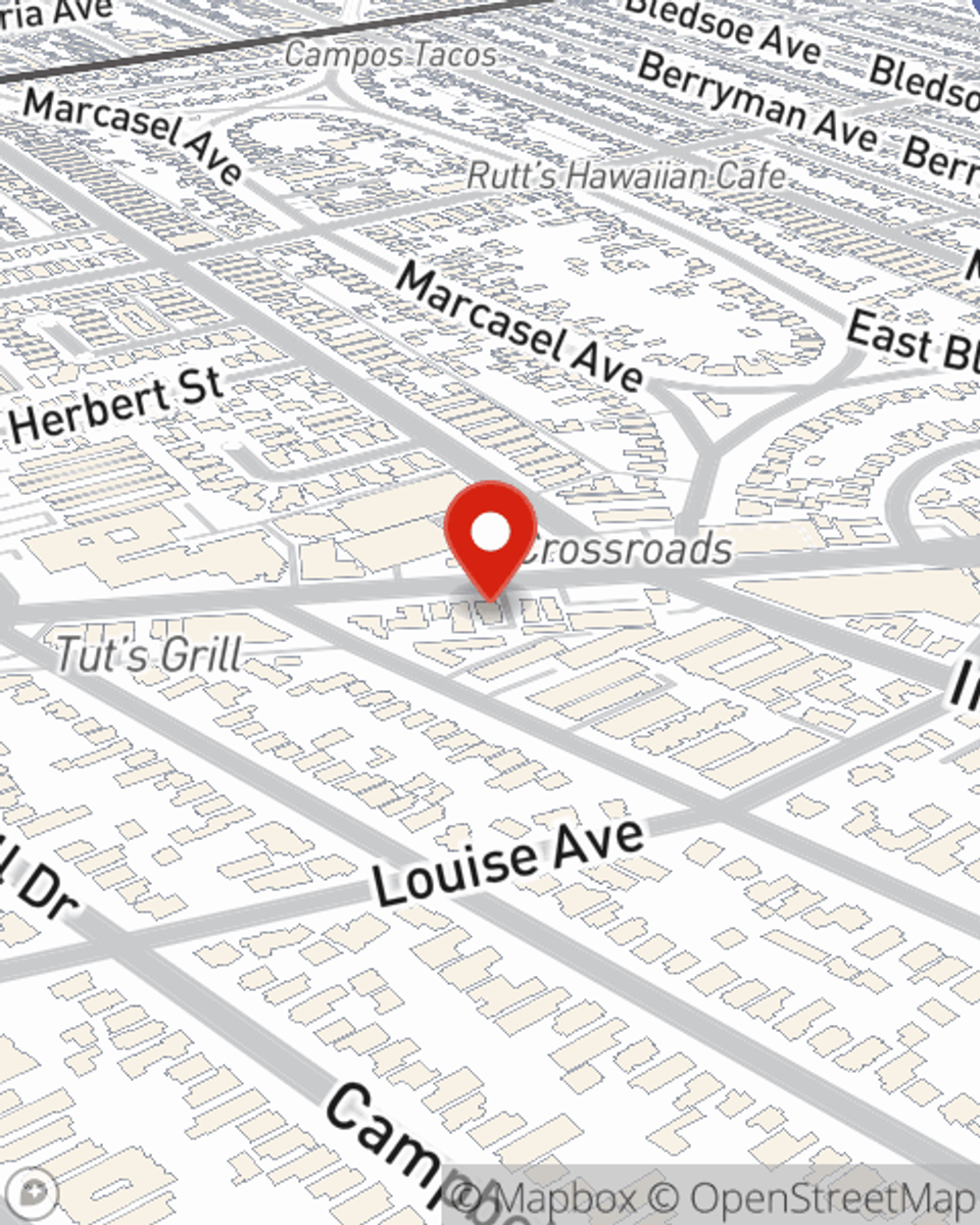

Life Insurance in and around Los Angeles

State Farm can help insure you and your loved ones

Life happens. Don't wait.

Would you like to create a personalized life quote?

- LA County

- Los Angeles

- Santa Monica

- Venice

- Brentwood

- Pacific Palisades

- Marina Del Rey

- Mar Vista

- Playa Del Rey

- Playa Vista

- Westchester

- Culver City

- West Los Angeles

- Westwood

- Beverly Wood

- Beverly Hills

- South Bay

- El Segundo

- Hancock Park

- California

- Arizona

- Nevada

It's Never Too Soon For Life Insurance

Can you guess the price of a typical funeral? Most people aren't aware that the common cost of a funeral in this day and age is $8,500. That’s a heavy burden to carry when they are grieving a loss. If the people you love cannot meet that need, they may be unable to make ends meet after your passing. With a life insurance policy from State Farm, your family can survive, even without your income. Whether it keeps paying for your home, pays for college or maintains a current standard of living, the life insurance you choose can be there when it’s needed most by your loved ones.

State Farm can help insure you and your loved ones

Life happens. Don't wait.

Life Insurance You Can Trust

Fortunately, State Farm offers various policy choices that can be modified to correspond with the needs of those you love and their unique situation. Agent Paul Major has the deep commitment and service you're looking for to help you opt for coverage which can aid your loved ones in the wake of loss.

Simply get in touch with State Farm agent Paul Major's office today to find out how a company that processes nearly forty thousand claims each day can work for you.

Have More Questions About Life Insurance?

Call Paul at (310) 482-3990 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

Simple Insights®

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.